Today’s advertisers have a tall order: reaching increasingly segmented audiences on an ever-growing set of platforms. To deliver the best possible results, they need the best possible insights from a reliable source.

The 2022 Comcast Advertising Report “is designed to provide modern advertisers with insights, data and predictions to help them succeed in TV advertising’s complex ecosystem,” says Comcast Advertising Managing Director Marcien Jenckes. It combines aggregated viewership and campaign data from Comcast, FreeWheel, and Effectv to paint a full picture of the state of TV advertising and the opportunities that lie ahead.

Download the report, then keep reading to explore key takeaways.

How Viewers Are Viewing

Households continue to watch traditional TV, but on their own schedule. Viewers are spending more than 6 hours a day with traditional TV and 71% of their TV viewing happens outside of primetime hours. 89% of that traditional household TV viewing is spent watching live TV, while 54% of digital video content viewing is live.

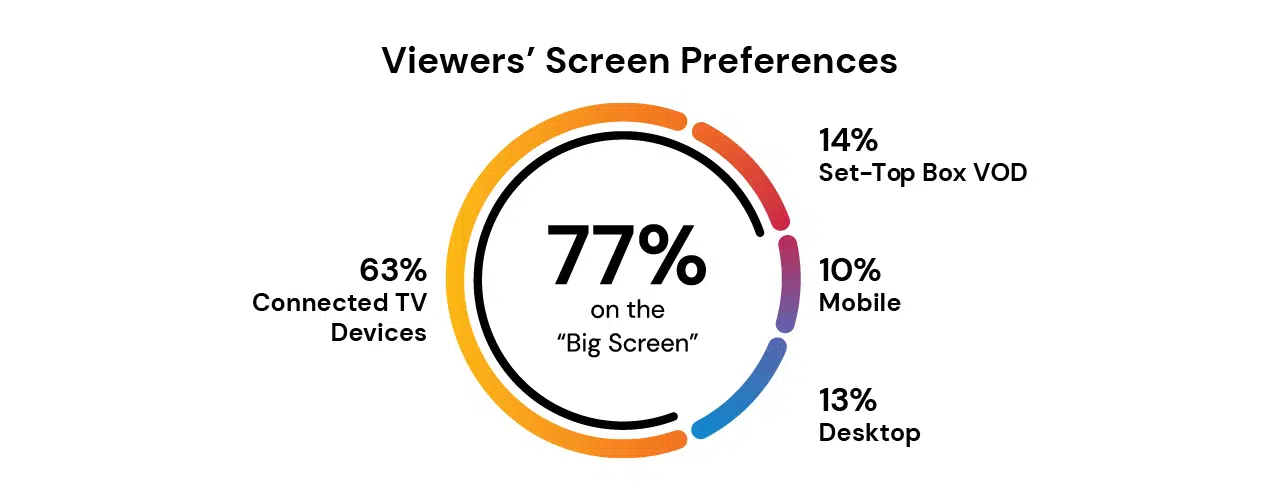

Even with a plethora of devices to choose from, nothing compares to watching the content you love on a screen that makes it look larger than life. A notable 77% of viewers still prefer watching on the TV screen, with 63% of that attributed to connected TV devices and 14% to set-top box video on demand. For advertisers, this trend creates additional opportunities, since bigger screens are more likely to reach multiple people at once compared to smaller personal devices.

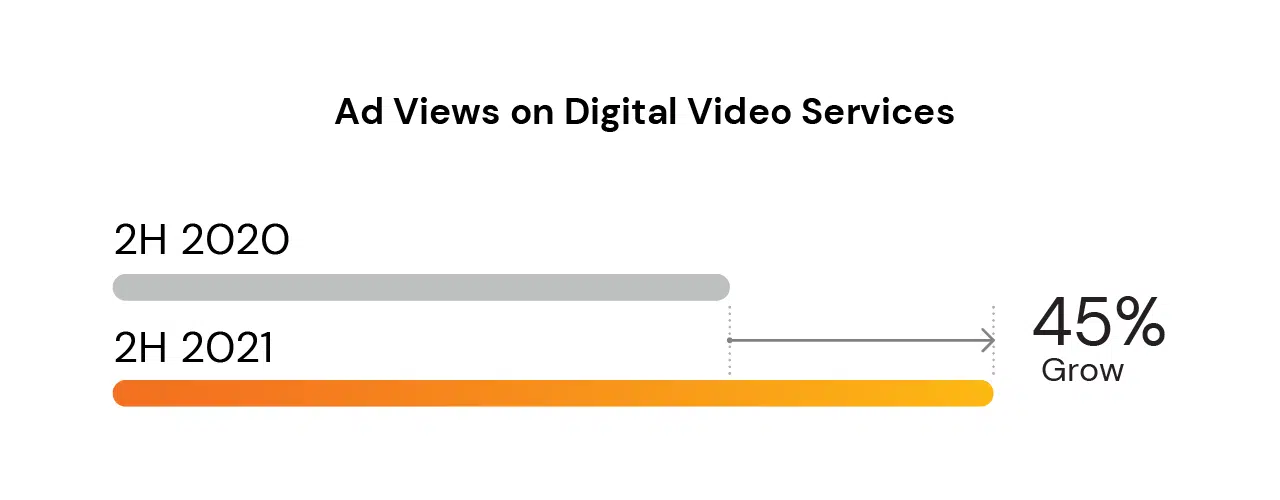

With these viewing trends in mind, reaching audiences through ads on digital video services is growing in importance for advertisers. The report found that between the second half of 2020 and the second half of 2021, digital ad views increased by 45%. Combine that with a recent survey’s finding that 75% of respondents are open to ads on streaming platforms so long as the content is free, and advertisers are in a good position to see ad views in digital video services continue to grow.

Advertisers should focus on following the audience wherever they choose to watch. Those who rely only on traditional “standbys” like primetime and top networks will see their campaign reach decline, as consumers spread out their consumption. By using viewing data across all endpoints, marketers will help foster an ecosystem driven by audiences and outcomes, rather than content.

How Buyers Are Buying

Advertisers increased their use of audience targeted campaigns by more than 50% YoY (2H 2020 to 2H 2021). The majority of advertisers are catching on to the opportunities presented by premium video content, with nearly 60% including a digital screen in their TV campaign to maximize reach in 2021.

Advertisers are also zeroing in on programmatic ads as a way to reach niche audiences more efficiently, with programmatic ad views growing by a staggering 80% YoY (2H 2020 to 2H2021). Advertisers are opting for assurance, with guaranteed programmatic deals accounting for 60% of all programmatic video impressions in the second half of 2021.

As the ecosystem grows more complex and audiences’ viewership behaviors spread out across platforms and devices, advertisers can rely on programmatic buying as a way to more effectively use their data, reach their audience, and connect with sellers. Automation, transparency, and control are the keys to success, and more advertisers are finding this in programmatic.

Thanks to data and programmatic automation, today’s advertisers should expect transparency, holistic buying options, and real-time reporting from their media partners, all of which bring a greater level of flexibility and fluidity to their campaigns.

What’s Working for TV Advertisers

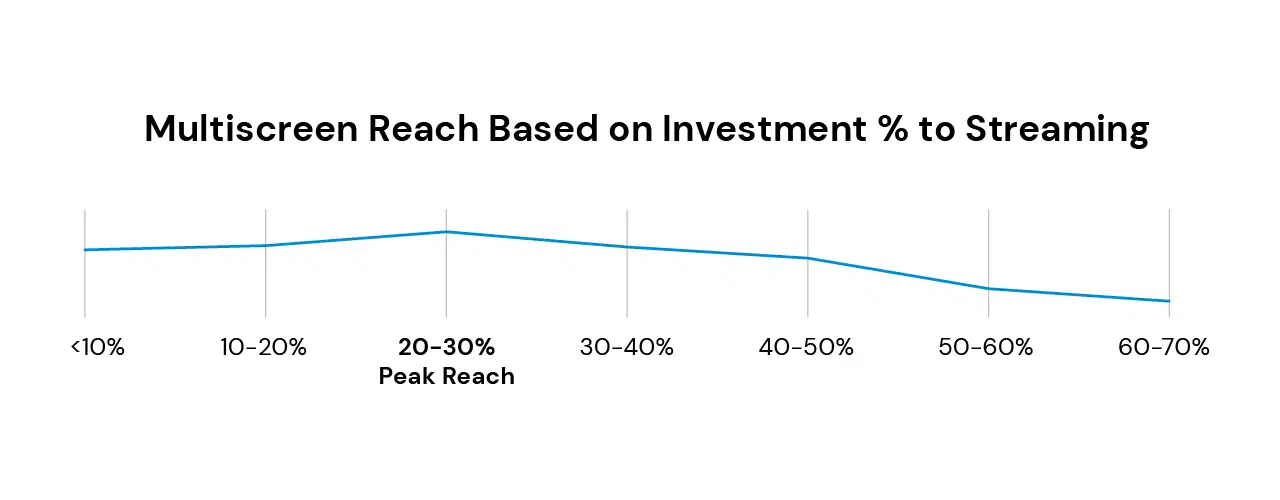

Effectv analyzed more than 20,000 multiscreen campaigns to uncover what’s working for TV advertisers. The results found that 82% of multiscreen campaign reach is unique to traditional TV, indicating that advertisers should rely on this placement as the foundation for media plans. Then, they can add streaming placements to enhance these campaigns by reaching households where traditional TV is off the table. Still, advertisers may wonder how to balance their investment across traditional TV and streaming.

Luckily, there’s a proven formula for success in balancing this investment. The report’s analysis found that multiscreen campaign reach was highest when 20-30% of an advertiser’s investment was allocated to streaming. While there is always room for slight adjustments depending on audiences and other factors, advertisers should keep this range in mind when planning their spending.

What’s Next

There’s no magic crystal ball to predict the future of TV advertising, however we can make some simple predictions based on the report’s insights, like the fact that streaming will continue to grow. As new digital video options evolve and expand in coming years, overall streaming viewership is likely to increase, as will streaming’s role in video advertising strategies.

The shift to audience-based buying will give way to new measurement currencies, and advertisers will double down on first-party data sources in order to get ahead of challenges posed to their audience targeting needs. Of course, this is easier said than done, which is why so many advertisers choose to partner with Effectv to reach their target audiences and provide measurable results.

Discover even more insights to guide your strategy and propel your multiscreen campaigns to the next level by downloading the 2022 Comcast Advertising Report.