Traditional TV has long been a fundamental advertising vehicle for national brands with messages intended for broad and niche audiences. Today, the use of data in TV advertising has expanded the medium from a vehicle used solely for broad awareness to a full-funnel marketing solution. Where traditional TV excels with its broad reach capability, addressable TV is used best to influence consideration, intent, and lower-funnel consumption behaviors among viewers who are most likely to be in-market.

And while savvy marketers know that both traditional and advanced TV tactics are optimal, finding the right balance can be a challenge. Can a brand demonstrate ROI amid a constantly evolving ecosystem where viewers watch on their own terms? That’s what a recent campaign analysis featuring national and regional campaigns for Cadillac sought to uncover.

Reaching audiences at scale with splashy TV ads like the “Labrinth Colors of Emotion” is a valuable piece of Cadillac’s advertising strategy. So too is finding the audience of viewers in the market for self-driving vehicles. But when considering the right mix of traditional versus advanced TV tactics, the general market lacks an efficient way to compare those tactics to business KPIs and how they relate to reach and frequency.

In working with General Motors (GM) and its agency partner dentsu, Effectv (the advertising sales division of Comcast) was able to use aggregated viewership data, which has the capability of showing ad frequency and buy rates by tactic when matched with pre-defined audience sets, to perform a campaign analysis comparing conversion rates for Cadillac’s advertising tactics.

The evaluation answered the brand’s biggest question: Did it sell vehicles based on ads delivered to the right audiences at levels that indicate a positive ROI?

Addressable’s Place in the Mix

Viewers continue to watch a lot of TV. Comcast households in the U.S. spent more than six hours a day with traditional TV in the first half of 2022. Of that time, 71 percent of it happened outside of primetime hours across an average of 31 different networks, according to Comcast aggregated viewership data. It’s a vast, widely distributed demographic, which creates a tall order for marketers tasked with finding and targeting their audiences on TV.

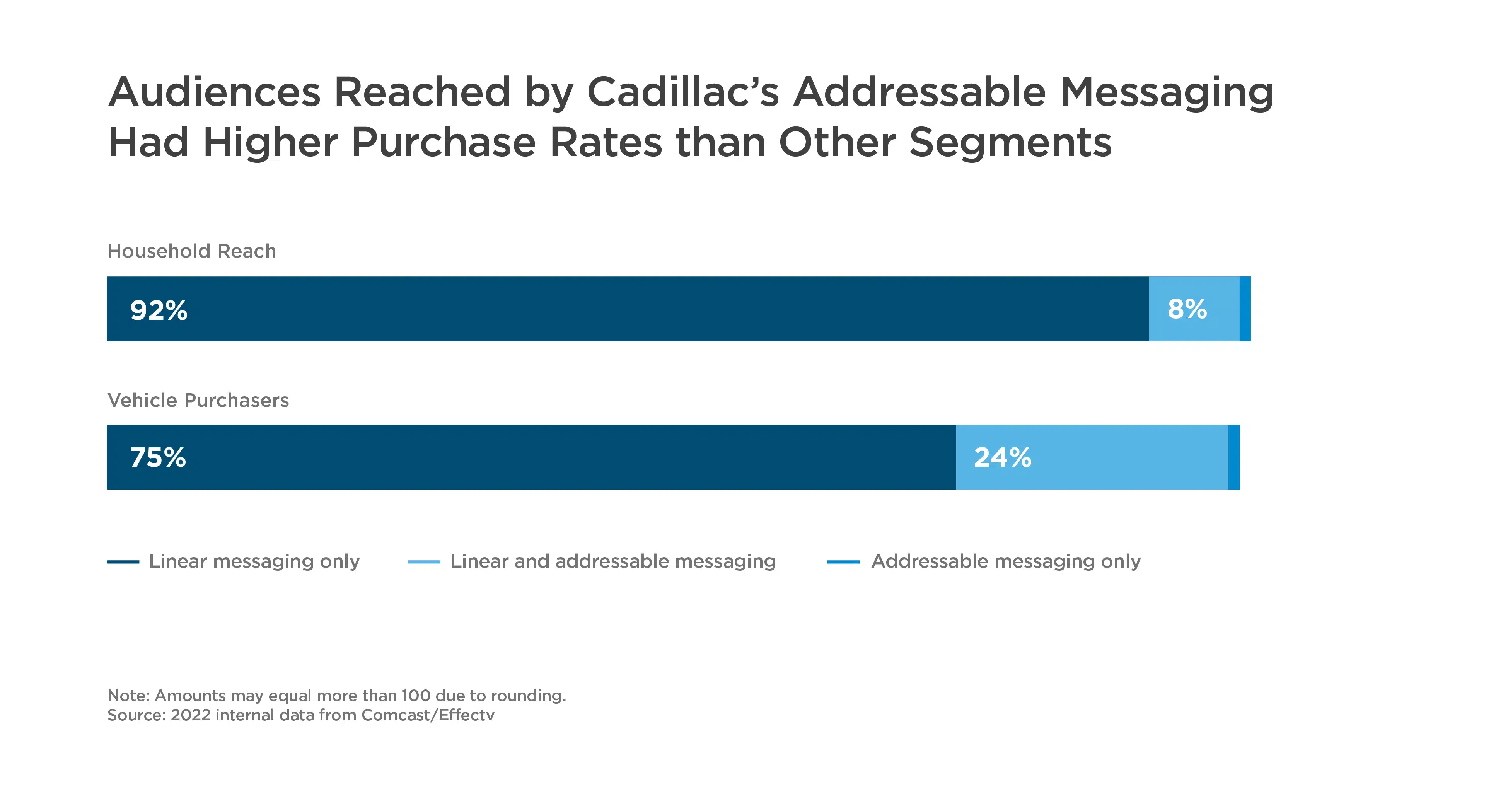

In the case of GM, whose ads ran over the course of the first quarter of 2021, 92 percent of the households reached by Cadillac’s messaging were exposed to the linear-only portion of the campaign. Almost 8 percent of households were reached through a mix of linear and addressable messaging. Less than 1 percent were reached through an addressable-only extension.

While linear-only messaging vastly out-paced the other portions of the TV campaign in terms of reach, that was not necessarily the case with households that were exposed to Cadillac’s ads and also purchased a vehicle. Of those purchasers, 75 percent were exposed to the linear-only portion of the campaign; 24 percent were reached by a mix of linear and addressable messaging; and 1 percent were reached by addressable messaging only.

What’s more, the Effectv analysis discovered that while linear TV reached more potential buyers overall, viewers exposed to addressable messaging were three times more likely to purchase a vehicle.

In fact, addressable TV had a higher rate of frequency than linear TV when reaching likely buyer households, with addressable TV messaging reaching likely buyers 136 percent as many times as linear-only portions of the campaign.

Part of that increase was driven by GM aligning proprietary audience data from dentsu with data on national and regional addressable-enabled households. This helped optimize its potential to reach desired audiences and was, ultimately, more effective in delivering a positive ROI from its addressable TV media.

Driving Results and Media Planning

Large-scale brands make investments in show-stopping ad creative that runs everywhere their consumers may see it. They know the value of sight, sound, and motion and how to capture attention through storytelling. TV has long been an effective piece of the media mix, but with a data-driven approach, marketers can attribute their investments to business outcomes.

With data from previous and ongoing campaign efforts as a baseline, media partners and agency teams can work together to optimize even further. Together, they can establish parameters for TV campaign reach and frequency that’s specific to the brand, invent new tactics to reach audiences across geographies, and combine digital tactics with TV’s capabilities.

This content has been modified from the original article published here on ANA.net.