A vehicle sale is just the start of an ongoing relationship between a customer and dealer, which can bring lifetime value and profit to a dealership. TV continues to be one of the most effective communication methods to inform and influence audiences. However, auto advertisers relying solely on linear TV, or solely on streaming, are missing out on reaching potential buyers.

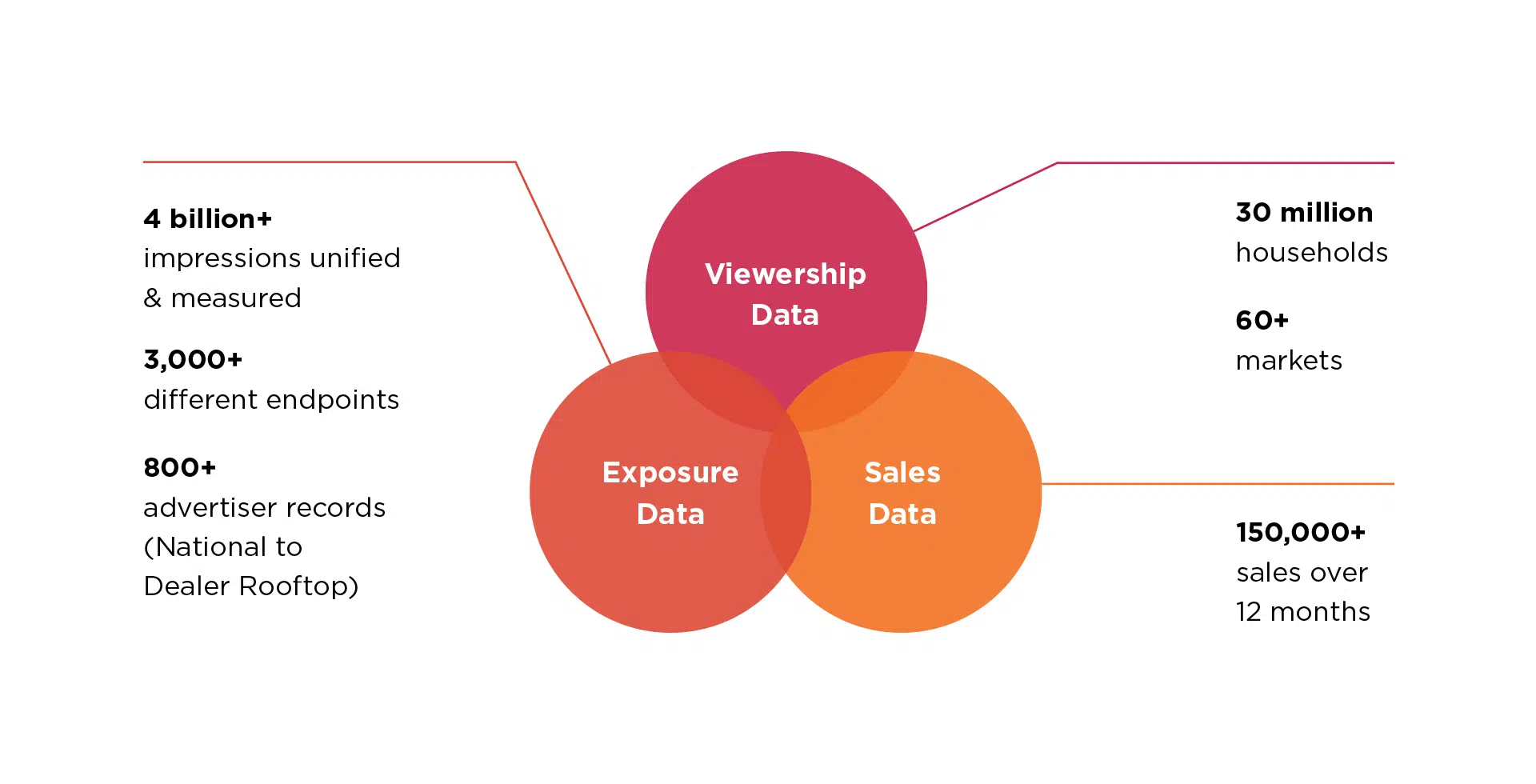

Comcast Advertising partnered with BlockGraph in an analysis that combined ad exposure insights from over 4 billion impressions matched to sales data from 150,000+ vehicle purchases over 12 months.1

Linear TV & Streaming Work Together to Deliver Buyers

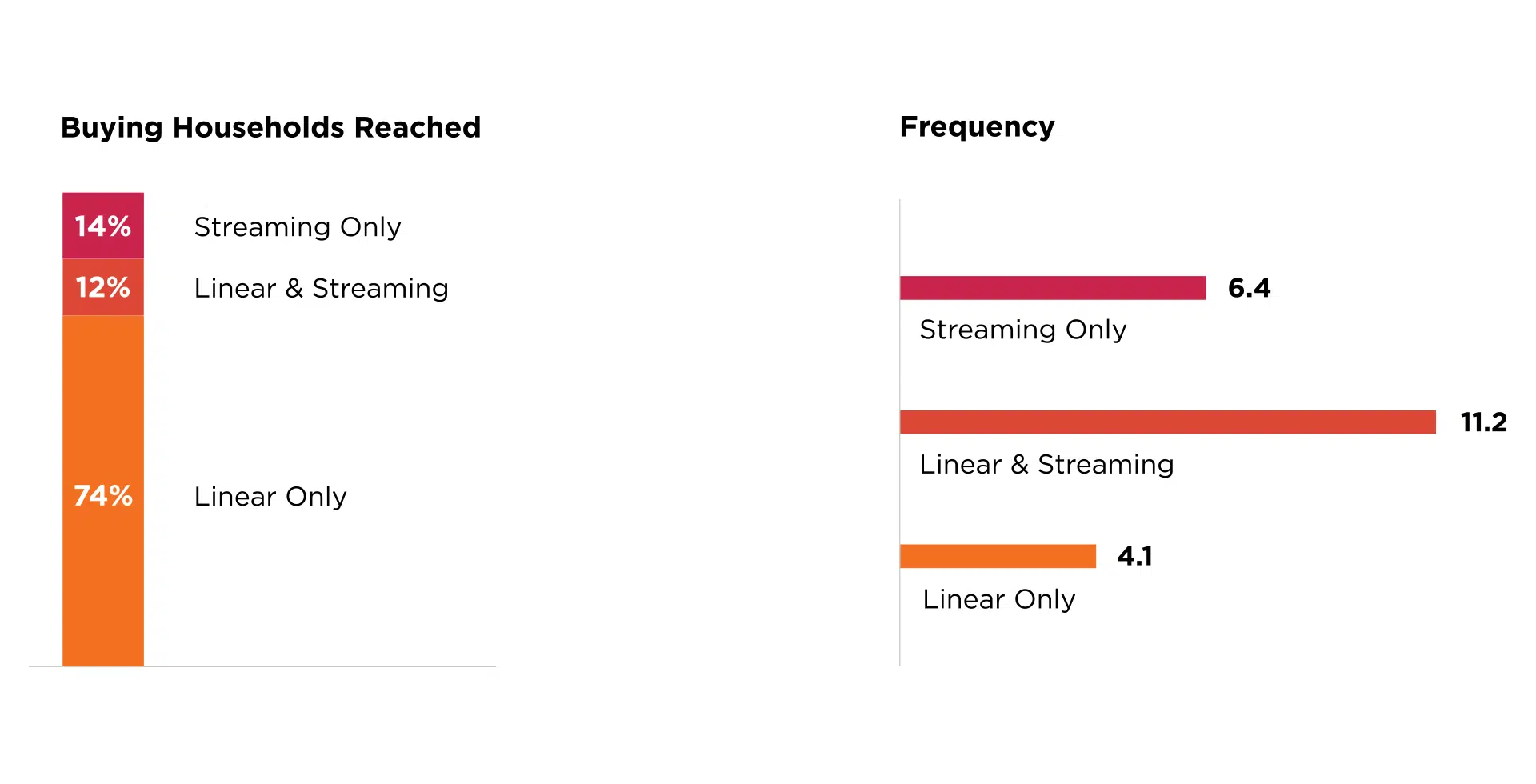

When looking at Tier 3 sales, most of the households that purchased a vehicle were reached exclusively by linear TV, while streaming provided an extension of audience reach. Households that purchased a car reached by both TV and streaming had a higher frequency (the number of times a household was exposed to an ad) than TV or streaming alone.1

Diversity in Viewing Endpoints Reinforces the Need for Multiscreen

Advertisers should utilize an impression-based advertising strategy that follows audiences among endpoints. To underline the importance of a multi-screen approach, our analysis determined that buying households were reached through a total of 1,000 unique endpoints. Additionally, households that bought a vehicle were reached by 150% more endpoints than households that did not buy a vehicle.1

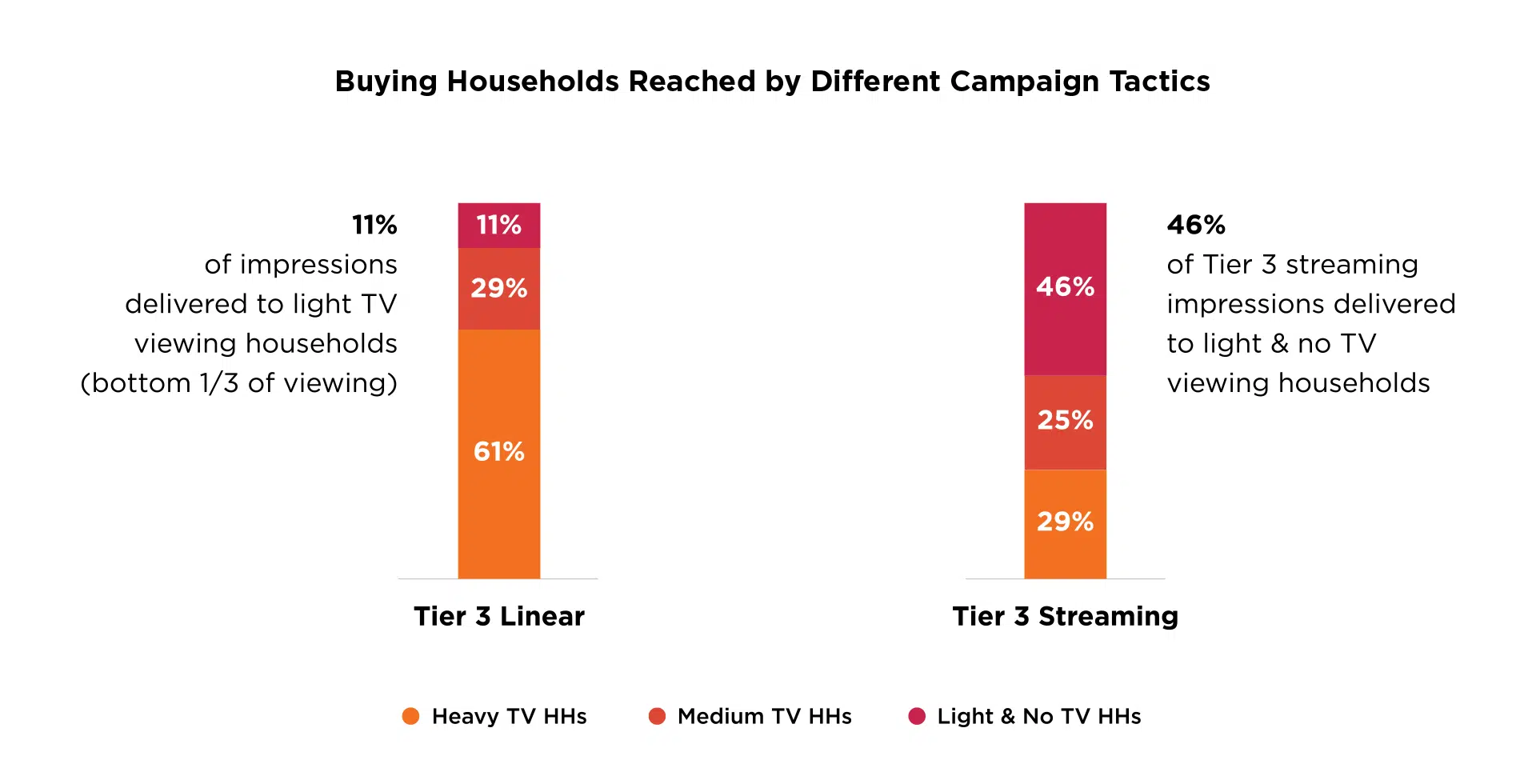

Streaming is Necessary for Hard-To-Reach Households1

Streaming impressions are more likely to go to buyer households that watch little or no TV. This is why it is so important to have a mix of both TV and streaming in your advertising campaign.

Download the infographic, to see more insights on what the right mix of streaming and linear TV is for your next multiscreen campaign.

Sources:

Comcast Internal Analysis of Ad Exposure data matched to Polk new vehicle sales using BlockGraph (2021 Jeep & RAM).

1a. Based on comparison of 20 dealers across 10 zones (2 dealers in each scenario. Time period, geography, and investment were consistent across scenarios)

1b. Multiscreen campaign for five consecutive months. Streaming-only in month six followed by multiscreen again in month seven.

1c. Dealer advertised eight months in the same zone. The campaign consisted of Multiscreen for four months & streaming only for four months